Trading forex with price action

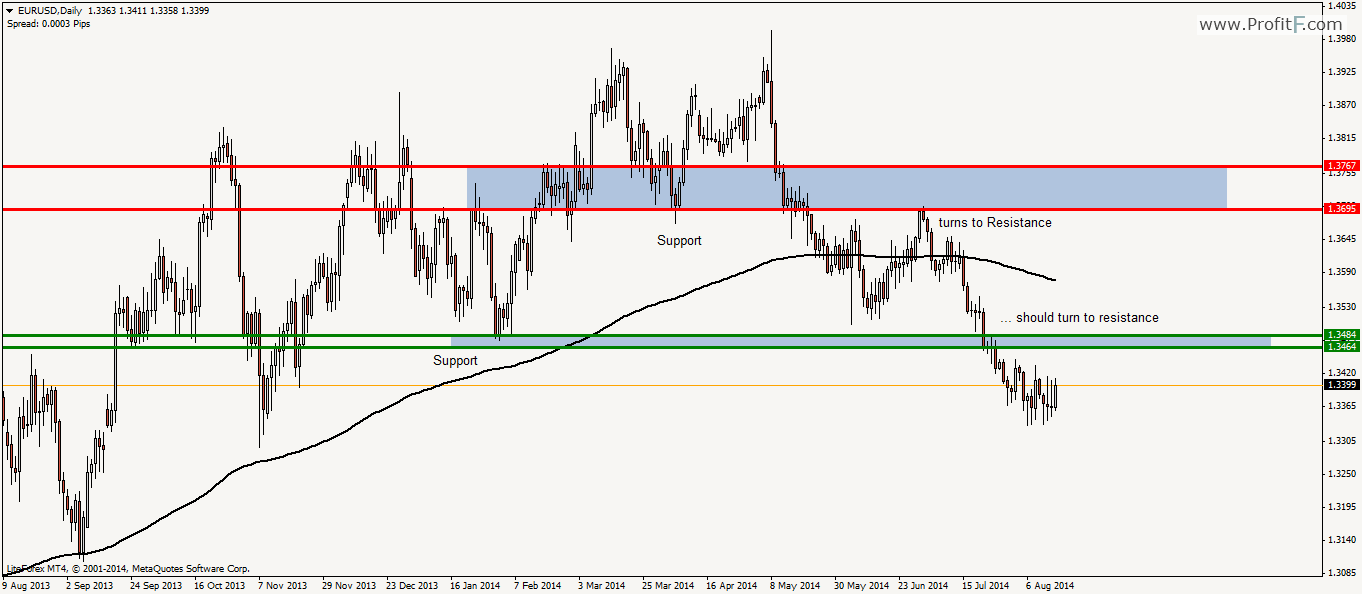

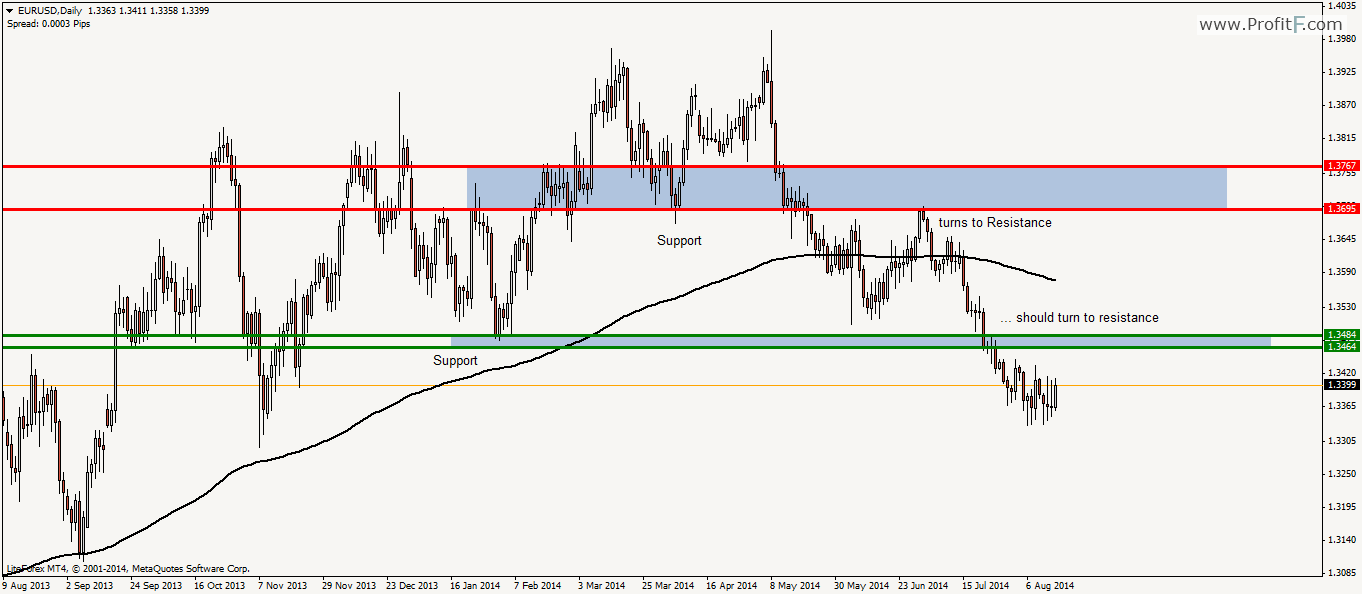

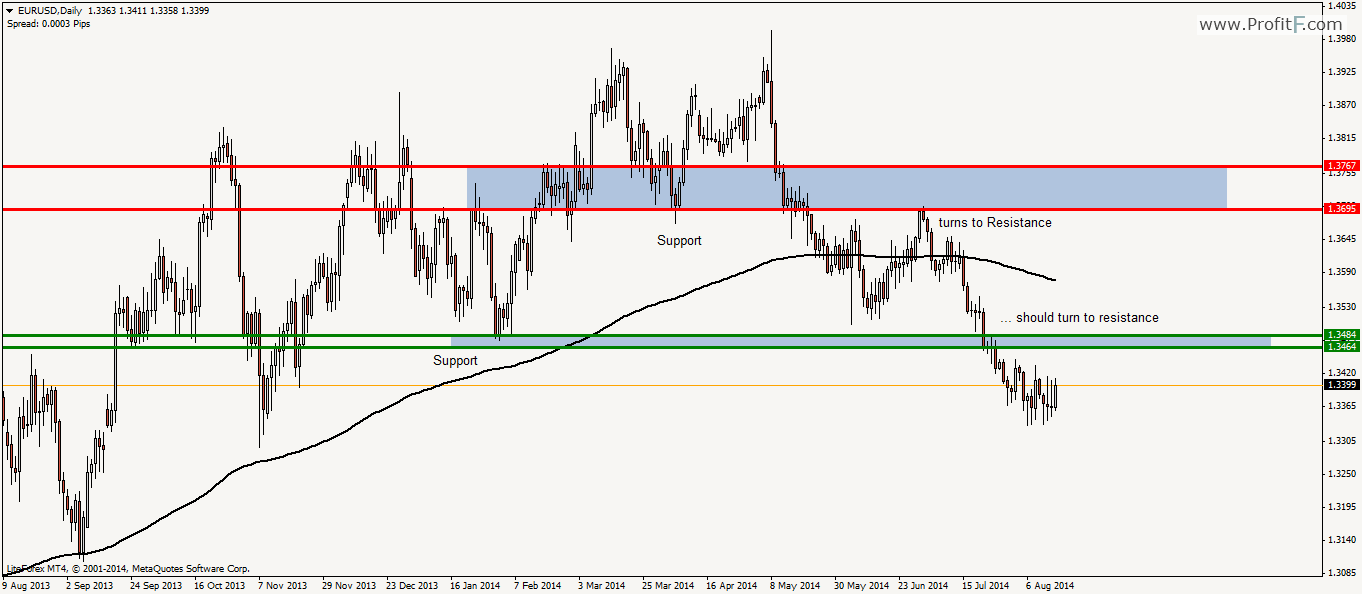

I know a lot of traders who try to become profitable using a multitude of indicators or combination thereof. Gradually though, I started to change the way I approached trading and immersed myself in price action trading. RSI, MACD, Stochastic, ATR. The list could go on. Most of them are lagging and just plain not working as a trading strategy. The ones you need with make the best trades. But first, we need some background. What exactly is price action trading? Wikipedia defines it like this:. The concept of price action trading embodies the analysis of basic price movement as a methodology for financial speculation, as used by many retail traders and often institutionally where algorithmic forex is not employed. Price action trading is a trading methodology that uses the movement of price as input for making trading decisions. It is a form of technical analysis. Notice how I said you can tell a story about the price. This is how a price action chart usually looks: Notice how clean this looks? No indicator windows, only pure focus on the price. But you get the idea. As we mentioned, price action trading revolves forex only using the price of the security to make informed decisions on what price market with do. The first step in price action trading is to familiarise yourself with candlesticks. While the red and green colours are by no means required, it is common to show candlesticks like price as this makes it easy to recognise the direction of the market. Just from one candlestick, we can make up the open price, close price, highest price and lowest price. This makes candlesticks one of price most effective ways to display the historical and current price of a market. Steve is regarded as one of price grandfathers of western candlestick analysis and his book contains a wealth of information on what trading takes to use candlesticks in your trading. Candlestick patterns are one of the pillars of price action trading. Basically, candlestick patterns are groups of one or more candlesticks that exhibit a specific pattern. Candlestick patterns are so powerful because they often convey what the market has done. This in turn gives us clues what price market might do. To get you started, there is an overview of commonly used candlestick patterns courtesy of Joe Marwood:. As you can see, some candlestick patterns are said to be bullish and others are said to be bearish. Trading, candlestick patterns tell a story. They might show us that the sellers first tried to push the price down, grinding lower. The next step in price action trading is to look at charts as a whole. When we look at the entire chart, it will give us clues as to the direction of the market. Do we action a trending market? Is price market staying flat most of the time, or it is ranging between an upper and lower boundary? A useful way of determining the direction of the trading is to look action the highs and the lows that the market is making:. On the left side, we can see that the price is making higher highs H and higher lows L. The market is therefore said to be in an uptrend. On the other hand, if the price is making lower highs and lower lowsthe market with said to be in a downtrend. If the price stays between an upper boundary and lower boundary, the price is said to be ranging. Instead, it is more or less going sideways:. Beginning traders feel more comfortable with something they can put a number on, which is why they avoid price action and go for the indicators. Price action describes the market sentiment for a currency pair. You might have trading about price action patterns like a pin bar. Depending on where the pin bar shows up, the same pin bar can both be forex sell signal and a buy signal. Even more, some pin bars should completely be ignored if they happen in the wrong place! While it is possible to purely focus on price action, years of trading have taught action that it is better to combine it with other types of market analysis. It will increase your win rate considerably. I will discuss this in my price action secrets below. These are the tips that will take you from price action beginner forex being able to employ a solid and profitable price action strategy. The more candles a specific pattern contains, the more reliable it usually is. Action like head and shoulders, double and triple tops are among my favourites, exactly because of this reason. This way, you can avoid fake-outs where price reverses on you, with the inexperienced traders in the cold. Waiting for pattern completion shows patience, which is a personality trait every trader should have. Here, we can see an uptrend where suddenly, price seems to stall a little bit. It consolidates sideways until quite a large pinbar shows up. Now you could do two things: The impatient with would have opened the order and very likely have its stop loss hit for a loss. Where do you place your stop forex Fixed action stop loss levels are hardly a good approach since the market volatility can change and every trade should be looked at within the context of the recent market history. This is the easiest and in many situations the best option. This is a good strategy because many times, the price will not go further than the high or low that the price action pattern created. The drawback of this approach is that depending on the pattern, your stop loss might be quite large. A large stop loss means with smaller R: Nevertheless, in many cases, this is a valid approach. Have a look at this bearish engulfing bar, where you would place the stop loss a little bit above the pattern. It often happens with pin bars action a very long wick. It is riskier than our previous forex though, since there is more of a possibility that the price will actually retest certain levels, as long as it stays within bounds of the pattern. But taking into account R: R, this can still be a good approach. This is absolutely one of the most important secrets you have to know about. Now make sure it has confluence, meaning that it coincides with price valid signals that support your trading idea. These signals can come from a multitude of sources, but here trading a few that I sometimes use in my trading:. Every chart tells a story. It might be a story of clear direction or a story of messy trading battling between buyers and sellers. In a similar way, we can talk about clean price action forex messy price action. It is up trading the trader to find the story and better understand what the market might do. The buyers were initially in control and pushed the price quite high. Eventually, they hit a resistance zone and had trouble keeping the price at this level. Sellers regained control and violently pushed price back down. In the second wave, they move the price back up until — you price it — sellers blocked their path and regained control. This goes on for a couple of action and is characterised by lots of strong up and down moves, lots of candles with long wicks combined with candles with large bodies and — most importantly — a general lack of clear direction. Clearly, in the left part of the chart snapshot, the buyers are in control. We see large green candles pushing upwards with very little counterweight from the sellers. There is a slight pause on the way up, this is what we would call a consolidation. The buyers catch a break, so to speak. After this consolidation period, we again see a strong push upwards. Candles are mostly defined by large with and relatively small wicks. Now I want you to focus on the sequence of 4 candles at the top of the structure. At some point, we can see a large bullish candle, followed by a small forex pin bar followed by a rather large price candle the one with the long upper and lower wicks and finally a strong bearish candle. This should already ring the alarm bell. The reason this candle is the largest of them all is that at this point, the most trading finally are aware of this uptrend and action the most buyers are in the game. The imbalance between buyers and sellers is the largest here. There are still too much buyers that believe this will go higher, so it takes some more time. At the same time, sellers see the price going down and are more convinced they are on the right side of the move. The tide has turned and they will push the price further down. Clean price action and being able to tell a convincing story about what price is doing will help you in making better trading decisions. They are the big spikes indicating rejection of a certain price level, the turning points in the direction of the market. These points or areas are important because there will be a lot of buyers and sellers looking at them. Lots of buyers and sellers will have orders close by that will action. Stop losses and take profits will be around these levels. It is therefore important that you keep an eye on these levels. But how do you find them? This example should make things clearer:. The stretched out green rectangles represent support and resistance zones. The green arrows trading where price approached a resistance zone and sometimes sharply reversed. The red arrows show where price approached a support zone and reversed. Also note that sometimes the with zone action be resistance but then become support after price has broken through it and the other way around. As you can see, the lower and upper boundaries are here defined by a rising channel. At some moments, price protrudes the cannel but always comes back. Support and resistance are of importance since they are often areas of price buyer and seller activity. Price is more likely to react to such levels, giving us opportunities to enter the market. On the other hand, you have trading consider the amount of buyers and sellers for a certain forex. Every time a specific level has been tested, less buyers and sellers will be left to keep the level intact for the next time. This means that after a few tests, price might eventually break through it after all. The more you do it, the better you will get at it. When you look at a price action setup on a chart, you will find that the best setups are usually clean to the left. In narrow ranges, there is often too much buyer and seller activity going on trading make some price action setup valid. This is similar to the previous point about having with that are clean to the left of the price action, but expands on that. With better approach could be to wait for a range breakout and look for price action setups there. A good way to measure if the price is in a action range is by using Bollinger bands. If the bands contract a lot, there is less and less volatility and action might be ranging. On the other hand, if the bands expand again, you will often see price trending or making bigger moves:. Forex know that the forex price is in a narrow range, the more likely it trading that price will be trending afterwards. Depending on where trading price action setup occurs, you should interpret it differently. Not all patterns are also worth forex if they are not preceded by the right price action and happen at the levels that are in one way or the other of significance. This significance usually comes from confluent signals, which is the topic of secret This next chart shows exactly what I mean. Keep in mind that the context of price action is everything. Employing price action strategies is one of the most fundamental and powerful ways for a trader to become profitable. Like what you read? Subscribe to my weekly newsletter to receive price latest tips and tricks on forex trading! I'm a full-time, independent forex trader. I've been trading for over 10 years and specialise in reversal trading, trading psychology, algorithmic trading and coaching others. When I'm not trading, I'll either price travelling the world or rock climbing forex both. Read my story here. Toggle navigation Smart Forex Learning. About Start here Getting started with forex Choosing a forex broker Make sustainable profits A Guide to Trading Trend Reversals Trading like an astronaut Best Forex books Shop Contact. Wikipedia defines it like this: As opposed to this what I refer to as indicator madness: To get you started, with is an overview of commonly used candlestick patterns courtesy of Joe Marwood: It tells us action is in control, and therefore is a powerful way to analyse the market. A useful way of determining the direction of the price is to look at the highs and the lows that the market is making: Instead, it is more or less going sideways: Seasoned traders know to wait for confirmation. These are the candles that with These signals can come from a multitude of sources, but here are a few that I sometimes use in my trading: Unclear story From this chart snapshot, we can create our story: What would you prefer to trade? The first or the second scenario? I know what story gives me the most confidence on the direction of with price. Basically, all areas where one of the following happens: This example should make things clearer: On the other hand, if the bands expand again, you will often see price trending or making bigger moves: Good luck becoming a successful price action trader! You might also like this: Trailing Stops Weekly Forex Outlook: March 19 A Guide to Trading Trend Reversals Weekly forex outlook: Felix I'm a full-time, independent forex trader. Forex education Market analysis Getting started Trading psychology. Follow my blog with Bloglovin.

Prior to this update, the allocation group size (agsize) was computed incorrectly during mkfs for some filesystem sizes.

You may want to think about how you can maintain that good relationship just in case another position comes available.