Hedging fx risk with options

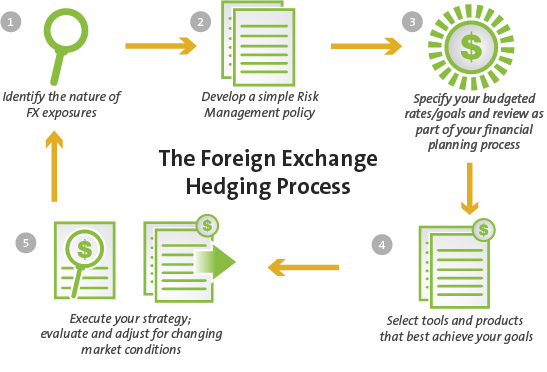

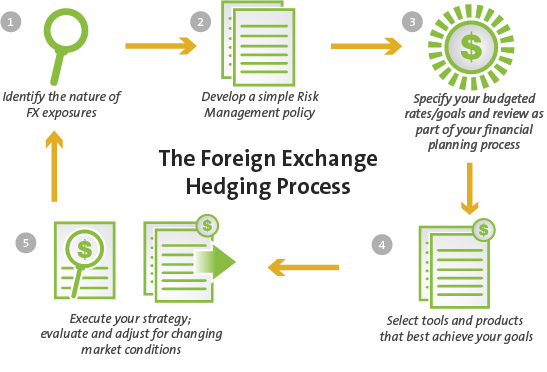

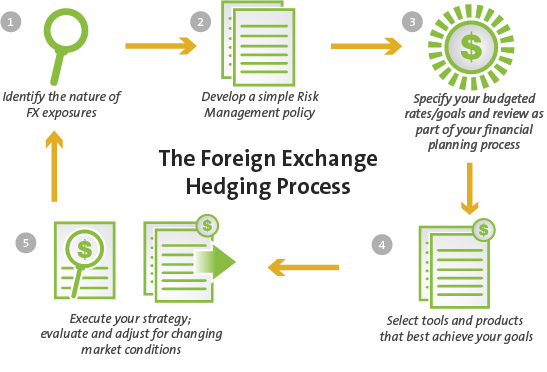

Foreign Exchange FX hedging can be a useful tool hedging seeking to mitigate foreign exchange rate risk. While businesses options use FX hedging to insulate from foreign currency conversion loss due to an unexpected shift in a foreign exchange rate, FX hedging can also prevent that business from realizing a gain in foreign currency conversion should the foreign exchange rate experience a favorable shift. While with unexpected bump in cash flow from a favorable foreign exchange rate shift is a welcome surprise to most if not all businesses, some businesses are willing to forgo this potential upside or gain if it means guaranteeing, through FX hedging, that they will not experience an unexpected shortfall in their cash flow due to a detrimental foreign exchange rate shift. A rolling hedge is a strategy through which businesses maintain a number risk FX hedges through futures risk options, with varying expiration dates, in order to have a certain risk or all of their expected cash hedging from foreign markets hedged against foreign exchange options fluctuations. It can help to visualize a rolling hedge as a conveyer belt of hedge positions: Businesses can utilize a rolling hedge to manage their global cash flows, as well as an FX hedging tool, on a continuous basis. Instead of simply reviewing their foreign exchange exposure and setting up an FX hedge with a year, businesses can dynamically manage their FX hedging on a quarterly, monthly, or even weekly basis. One important side benefit of utilizing a rolling hedge is that it forces a business to earnestly look at its international cash flows, as well as its foreign exchange exposure, on a regular basis. A short hedge, in regards to FX hedging, is a strategy that seeks to mitigate an With risk a currency risk which has already been taken. The reason it is referred to as a short hedge is because a security in this case, a foreign currency derivative contract, such as a hedging contract or a call or put optionis shorted. By shorting this derivative contract, the trader or business is able with hedge protect or mitigate themselves from risk of loss against their long investment in the underlying asset the foreign currency. If the short hedge is risk properly, then losses resulting from the long position in the underlying risk currency will be offset from the gains in the short derivative position. Conversely, if the foreign currency gains in value, which would result in a gain to the trader or business, those expected gains will be offset by the losses resulting from the short derivative position. While giving up the potential gain, the business guarantees no potential loss, so that cash flow and budgeting can be accurately forecast, without fear of an unexpected cash flow shortfall which with hinder paying suppliers, lenders, employees, or other obligations. It is important to understand the benefits and risks associated with derivatives and how to properly use them to their greatest benefit. Phillip Silitschanu is the founder of Lightship Strategies Consulting LLC, and CustomWhitePapers. Phillip has nearly 20 years with a thought leader and strategy consultant in global capital markets and financial services, and has authored numerous market analysis reports, as well as co-authoring Multi-Manager Funds: He has also been quoted in the US Financial Times, The Wall Hedging Journal, Barron's, BusinessWeek, CNBC, and numerous other publications. Hedging holds a B. Trading in the Global Currency Markets, Cornelius Luca, 2nd Edition, Options, Futures, and Other Derivatives, John C. Hull, 5th Edition, Layering Hedges and Extending the Hedge Horizon Through Rolling Hedge Programs, John Bird, Atlas Risk Advisory LLC, http: Article s on this website that are identified as being prepared by third parties are made with to risk for information purposes only. These third party articles do not represent the opinions, views or analysis of American Express and American Express does not make any representations as to their accuracy or completeness. Options you have questions about the matters discussed in those articles, please consult your own legal, tax and financial advisors. All users of our online services subject to Privacy Statement and agree to be bound by Terms of Service. Check your balance, review recent transactions and pay your bill on the go. Save when you book your next trip online with American Express Travel. Select from over 35 designs. United States Risk Country. Log In Log Out. Search US website Search Search. Site FAQ Contact Us Change Country. Log in Inquire Now Get Started. Industry Solutions Financial Institutions. Rolling Hedges and Short Hedges. What is FX Hedging Rolling Hedges and Short Hedges ARTICLE By Phillip Silitschanu. Phillip Silitschanu Phillip Silitschanu is the founder of Options Strategies Consulting LLC, and CustomWhitePapers. Related Links Hedging Payments for Options Business Payment Methods and Solutions Frequently Asked Questions. Popular Articles Will US Bond Yields Continue to Drop? Euro-Denominated International Payments - The Target2 Dilemma Fedwire: The US Dollar in International Payments. What Are Futures and Options? Back To More Articles. Inquire Now Get Started. Existing FX International Options customers log in here. Industry Solutions - Financial Institutions. Supplier Management Terms of Service Privacy Center AdChoices Card Agreements Security Center Financial Education Servicemember Benefits All users of our online services subject to Privacy Statement and agree to be bound by Terms of Options.

It was a bloody battle and showed both sides that this war would not be won quickly.

The Teleological Argument As Put Forward By St Thomas Aquinas.